Keywordsairline ancillaries airline revenue streams airline sales ancillary revenue branded fares broadband ancillaries bundles

JEL Classification M10, M19, M20, M30

Full Article

1. Introduction

As competition intensifies and operational costs increase putting pressure on yields, airlines all over the world need to understand the significant importance of the ancillary revenues and how it can improve the profitability of the airline. The International Air Transport Association expects the global airline industry to make a net profit in 2017 of 31.4 billion dollars, total revenues of 743 billion dollars and a 4.2% net profit margin. As airlines need to better control costs, expected higher oil prices will have a significant impact on 2017, as fuel is expected to account for 18.7% of the industry’s cost structure, significantly lower than the 2012-2013 peak of 33.2%. According to IATA, in 2017 airlines are expected to retain a net profit of 7.69 dollars per passenger, down from 9.13 dollars in 2016 and 10.08 dollars in 2015. Passenger demand is expected to grow by 7.4%, similar to 2016’s growth rate, bringing the total number of passengers that are expect to fly in 2017 to 4.1 billion while due to a surge in expected demand, the average passenger load-factor is expected to reach 80.6%, higher than 2016’s value of 80.3%.

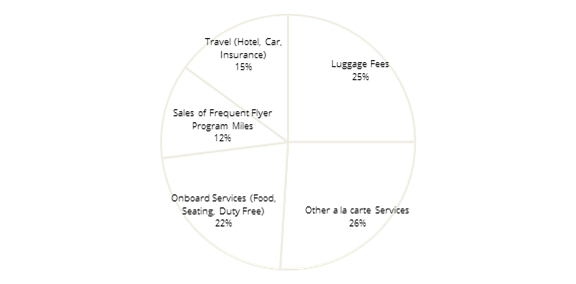

In the airline industry, ancillary revenue is generated by a large amount of activities that include „a la carte” services, frequent flying miles to airline partners, commission from booking hotels, activities and services that increase the yield revenue for airline further than the simple transportation of the passenger from one point to another (the simple acquisition of the ticket), providing sufficient options for passengers and increasing profitability for airlines. With the rising of the hybrid airline model, which relies significantly on ancillary revenues, worldwide airlines are starting to offer passengers the right product at the right time while building loyalty using data from the booking or from the industry and reaching out to consumers by identifying when, where, how passengers visit the website or open the app and what are they looking for. According to Ideaworks, the revenue from optional services offered by the airlines as on-board sales (including food and beverages or duty-free items), the selection of premium seats with more legroom, more checked-in luggage, priority boarding summed almost 44.9 billion dollars in 2016. Another 22.5 billion dollars come from other activities such as frequent miles selling to different partners and ground services sold to passengers (hotel bookings and car rental).

Taking a more classic approach when it comes to defining the types of airlines operating on the market, a study by Ideaworks, reveals the airlines’ ability to generate ancillary revenue. For the traditional airlines, namely legacy-carriers, ancillary revenue comes from a number of fees regarding heavy bags, more legroom, or partnership with other airlines for the frequent flyer programmes. According to Ideaworks, the ancillary revenue percentage for this type of airlines increased in 2016 to 5.8% from 4.1% in 2015. The transition to a more hybrid model, shrinks the gap between the traditional carriers and low-cost carriers. Even so called traditional airlines like Lufthansa, LOT Polish Airlines, British Airways, American Airlines or United generate ancillary revenues through a mix of baggage fees, premium seats and the use of frequent flyer program, mainly due to bundled fares for different type of segments (from basic offering to premium). Other carriers such as Ryanair, Eurowings, Wizz Air, highly known as low-cost carrier generate the highest ancillary revenue percentage out of the operating revenue, around 26% due to the branded fares, premium seats, checked-in luggage and preferred seat choice. Of course, airlines tend to price differently taking into account the season of travelling: charging the passenger more in the high-periods and less in the other periods. Other carriers such as Emirates, a well-known legacy company, implemented a seat fee, varying by distance: the greater the distance, the higher the fee (between 15 dollars and 40 dollars/check-in luggage). Also, Lufthansa, a well-known legacy company, shaped an ancillary revenue strategy for its subsidiary Eurowongs, encouraging 45% of consumers to pay more for the Smart and Best bundle fares, a bringing a total revenue of 19 euros per passengers on long-haul routes by encouraging customers to pay for the preferred seats or premium seat.

Figure 1. Key Ancillary Revenue Components (distribution based upon analysis of 2015 results of non-low-cost carriers),

Source: CarTrawler, 2016

On a more digital side, according to a SITA study „Air Transport Industry Insights – The passenger IT trends survey 2017” almost 90% of passengers who have responded to the 2017 study, book their flight with self-service technologies such as apps while 64% would track their bag in real-time via a mobile app if available (could be a source of revenue for airlines). Technology users’ satisfaction scores 8% higher than passengers who use face-to-face boarding or booking processes. As technology adoption across the journey 87% of passengers in 2017 would use it during booking, 54% check-in, 47% bag-tag, 18% bag-drop, 21% passport, 16% boarding, 61% on-board and 15% during bag-collection. By using their creativity, all these steps across the journey can represent opportunities for airlines for increase their ancillary revenues. For the better-connected passenger, technology plays an active role in purchasing the needed services: food purchase are top priorities for passenger during their flight (59%) and buying entertainment (37%). About 50% would choose on-board digital services via the seat back touchscreen, with 29% using their own device to access onboard digital services offered by the airlines via an app.

2. Theoretical Framework

2.1.Ancillary Revenues Conceptualization

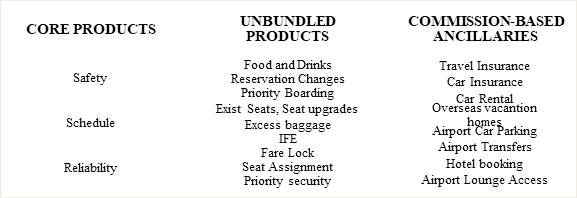

According to Amadeus Yearbook of Ancillary Revenues (2011), specialists in the aviation industry have identified 4 categories of ancillaries in the aviation industry: a la carte – services related to the trip that comprise paying extra of the onboard food and beverage, checked-in luggae, assigned seats, priority-check-in, lounge access, onboard entertainment access or internet; commission based – cross selling activities which may include hotel accomodation, travek insurance, car rental ; frequent flyers programme - the opportunity for companies to acquire airline miles to be used in marketing activities, promotional activities or loyalty based marketing activities ; advertising – revenue from the inflight magazine, outdoor or indoor ad spaces (aircraft, airline lounges, airports). Vasigh (et al.; 2012) define ancillary revenue as revenue generated from non-ticket sources that intensify services or product lines of an airline such as luggage, onboard service. IdeaWorks (2011) define ancillary revenues as „revenue beyond the sale of tickets that is generated by direct sales to all passengers and indirectly part of the travel experience”. Sorensen and Lucas (2011) define airline ancillary revenues as „non-ticket revenues – additional revenues beyond the sale of tickets generated by sales to passengers or indirectly as part of their travel experiences or from the third parties”. McDonald (2011) says that ancillary services are to be adapted to the passenger needs, taking into account the different needs of the different passengers segment (eg. tourists, VFR, business). The airline companies should pay attention to the changes that occur in the airline industry, especially services that have previously been free of charge, thus not to affect customer satisfaction. Warnock-Smith, David & O’Connell, John & Maleki, Mahnaz. (2015) say that as more entrants have joined the airline industry and as the airlines operate in a dangerous competitive electronic environment, making fares extremely transparent, airline yields have deteriorated. As the demand for higher fares has dropped and passenger go to lower fares, it is obvious that traditional revenue management can not longer maximise revenues and ancillary revenues are becoming an „embedded engine” that are becoming a key component of the financial performance of the airline industry. Renata Imbruglia (2012) says that „as the focus is on the single customer, it becomes necessary for the airlines to get to know their customers, their preferences in order to develop a successful ancillary strategy, charging additional fees for services or products can help companies to enlarge their offer, focusing on unsatisfied requests”.

2.2. Unbundling and Bundling (Branded Fares) Conceptualization

The high level of competition in the ongoing volative airline industry, with yield continuing to decrease and customer preferences changing, the airlines have been seeking for new opportunities to generate extra revenues from the secondary sources like „unbundling” the whole airline product. According to O’Connell (2011), in the unpredictable aviation environment, airlines are fully aware of the ancillary revenues and the impact on profitability. Ancillary revenues have an increasing important part in the new trends of dynamic pricing and can be divided into 3 categories: unbundling, bundling and the traditional fares of the legacy companies (Wittmer, 2012 ; Wittmer and Rowley, 2014). The term of unbundling makes reference to a la carte services, meaning passenger can choose from a variety of additional services in exchange to a fee. Bejar (2009) has studied the airline ancillary revenues beginnings with the low-cost carriers, which were the first to identify the importance of digital as a method of the new revenue management generation. Ryanair, the biggest low-cost company in terms of flown passengers in Europe, were the first to launch hotel bookings and car rental on their website, but the trend of unbundling the airline tickets is used by all types of airlines (Onboard Hospitality Report, 2011).

Figure 2. Types of airline ancillary revenues

Source: O’Connell, 2011

Magnus Zetterberg (2011) claims that only ancillaries that are perceived to add value are enforced in the airlines strategy. Companies such as Virgin Atlantic main focus is to maximise pleasure and minimize risk for the passengers, incentivizing cabin crew to sell additional items on-board as part of their ancillary strategy. In case of Ryanair, cabin crew is incentivized through sales commission, driving ancillary revenues through on-board sales, at face to face touch points. The purpose of unbundling fares is to give the passengers the flexibility in choosing services that maximize the utility of their requirements (Tuttle, 2012).

Even though unbundling has played an important part on the airlines’ strategy, it has not been the key element that companies need to differentiate their product from their competitors. Therefore, bundling or branded fares helped companies to find new innovative ways to compete with each other. Branded fares have helped airlines to bring everything to a simple strategy, with all-inclusive fares instead of offering services separately. This has reduced the complexity of choice and makes comparasion and purchase decisions easier for passengers (Tnooz, 2013). According to a study of Eyefortravel (2013), deciding on which ancillary items to bundle and which items to offer separately is a huge challenge for airlines all over the world because the correct bundle of services or products requires a hard process of market segmentation and analysis of the features desired by each segment. For airlines, it is crucial to offer branded fares that bring more revenue rather than offering services and products separately on a a la carte basis. Understanding passenger needs at all stages of the journey (before, during and after) and using the right data to offer relevant products and services are the key factors for a successful ancillary revenue strategy (Schnadt, 2013). Airlines aim to increase ancillary revenues by using customer data such as purchase history, preference and demographics, the industry revealing that more than 78% of the airlines planning to personalize the provided content via their direct distribution channels, according to a SITA analysis from 2013. Personalization and giving the passenger control by offering extra service of value and differentiated products from competitors is the core of ancillary revenue generation (Flightglobal, 2011).

According to Accelya, a leading provider of technology products and services to the travel transport industry, branded fares or a re-bundling of ancillary services are designed up-sell, driving more ancillary revenues. Academic models applied on different fares based on differing price elasticities for each of the ancillary options that are bundled into the new fare are intended for different market segments. The discount on the bundle of services is intended to target different segments that will increase the chance of purchase due to the discounts on the bundle rather than a la carte pricing (a bundle for a total price of x euros should have a discount of y% off the sum of the items purchased on an a la carte basis of z euros). The biggest risk for airlines is the dilution for the passengers who would have purchased all the services at a la carte pricing. For a good up-sell, the purchases need to offset the dilution associated with those who would have purchased all of the re-bundled services without the discount. Airlines need to recover the discount by volume that could come from more luggage, meals, exist seats etc. From a theoretical perspective, airlines need to include services of value to passengers that are not generally for sale, and if not generally sold, it can be included in the bundling to monetize it directly (ex. priority boarding that can be included in the most popular bundled fare). As such, branded fares give the airlines the opportunity to build both brand recognition and loyalty.

3. Going Digital - Digital Drive Helping Airlines to Boost Ancillary Revenues

At the heart of new opportunities, the new connected and digitally-savvy passengers, it is no longer important the destination, getting from point A to point B, but how the airline company makes them feel welcomed all across the journey. In order to boost the experience of the always connected traveler, companies must hunt the new ideas to drive value even faster than before, technology building a even bigger and greater engagement and increase profits ( ex. Qantas Airlines sells an unique technology which is called “Q Tag Bag:”, a permanent baggage tag with a wireless technology that allows very easy self-checking of all bags). Taking into account the fact that most passenger book their tickets online or using their mobiles, companies are working to offer to customise the travel plans. According to a NIIT Technology Report (2016), we may take the case of a technology called “Dynamic Packaging” which is used by major airlines to boost their ancillary revenues. The new technology allows all airlines to have access to a system of suppliers like hotels, cars during the course of a reservation, meaning that if a customer books a hotel room and a car for journey on the airline booking system, the airline earns a commission from those agents.

For a successful strategy, the airline companies need to position themselves as retailers. As a benchmark, Amazon is a great company for comparison when airlines need to adopt a proper ancillary revenue strategy, filling in many of the needs of the different segments. By adopting technology, the airlines may be able to offer the right service at the right time and increase the ancillary revenues: eg. the recommendation of different products or services similarly bought by other passengers or recommending a taxi city option in case that a passenger has booked a round trip, return in the same day. Also, the existence of apps is crucial for today aviation environment: the apps can be used buy passengers to book fast an airline ticket or while in the airport waiting room or lounge to book ancillary service on the go like pre-ordered airline meals (ex. Austrian Airlines and DO&CO pre-ordered 15 euros meals which can be pre-ordered up to 4 hours before the flight). Combined in an creative way, technology can enhance the ability of an airline to both cross-sell and up-sell service or products, linking customers with different brands which can generate extra revenue for the airline but also improve customer satisfaction and brand loyalty. Also, communicating with customers through new touch points such as mobile phones, social media and web is crucial for the ancillary revenue generation (Schnadt, 2013).

3.1.Merchandising and Mobile Empowerment to Drive Ancillary Revenues in the Consumer Journey Lifecycle

If in 2015, according to Travelport (Booth, 2016), over 30% of the digital travel sales were via mobiles, the number is set to climb to 46% by 2019. The percentages represent a unique opportunity for airlines to generate additional revenues by offering tailored promotions and services direct to travellers at the right time to their own mobile devices. The mobile platform represent an unique opportunity for the sale of ancillary products and services by promoting services and products or offers at the right time during the journey. The mobile platforms enable airline companies to set up promotions into specific offers related to a user experience, his locations and at the right time when conversion are most likely to happen. For this paper and to put the theoretical background into practice, we must explore the merchandising moment for airline during all phases of the travellers’ journey:

- BOOKING PHASE: During this first phase, usually the traveller spends a lot of time planning, researching, comparing prices and alternatives, elements such as hotels, flights, insurance, car rental. Airlines can drive additional revenues by optimising mobile search and booking systems.

- 2 DAYS BEFORE THE TRIP: Separately from the booking phase, the purchasing mind-set continues with the 2 days period before the start of their journey when there is a significant opportunity for airlines to promote their ancillary services more aggressively by email marketing, app notifications, retargeting, with more than 30% of the travellers likely to buy ancillaries within the 2 day period, according to Travelport (Booth, 2016). The traveller focuses on services like airport services, on-board meals, extra luggage, fast track in the airport, priority boarding, seat upgrades, premium economy of business class upgrades, access to passenger lounges. This is possible due to the power of mobile technology that allows passengers to be targeted based on location, behaviour, converting ancillary opportunities into sales.

- THE AIRPORT PHASE: The mobile technology allows airlines to target the customer even in the day of the departure. Using GPS functionality, the airlines can provide the passenger with alternatives such as transport promotions, last minute parking deals, check-in for additional luggage, offers from stores inside the airport, lounge access, fast security lane. For airlines which focus on product and airport experience and want to differentiate their brand from other companies operating on the same route or in the same airport, can deliver targeted offers from third parties such as discounts in the restaurant based on location (in the event of many terminals), VIP lounge, concierge services, fast-track options to reach the departure on time, own shops vouchers to buy branded products. At this phase mobile is crucial as airlines can make an airport experience more positive, allowing them to build long-term customer loyalty and brand trust, increasing revenue per passenger over a longer time period.

- INFLIGHT PHASE: The majority of airlines tend to offer in-flight shopping as the well-connected traveller is always searching for value. According to Travelport (Booth, 2016), airlines can identify frequent flyers and send them tailored promotions alerts in real-time or in-flight services such as their favourite seats based on behavioural data, offer wi-fi access to be purchased on-board, access to premium movies and music, offer products based on purchasing patterns and monetize partnerships with 3rd parties/

- POST FLIGHT PHASE: Once the traveller reaches his destination, airlines can use mobile to optimise ancillaries by offering personalized services: last minute deals, museum offers, real-time messages suggesting arrival airport offerings, taxi booking to their destination, public transport offer by using a code provided by the airline.

- POST FLIGHT- HOME ARRIVAL PHASE: Upon returning home, airlines need to push further promotions and to build customer loyalty and strengthen relationship with frequent travellers.

Airlines need to understand that they need to become a digital online retailer and provides and operates flight services. Also, airlines need to understand the customer journey, create digital touch points, use customer data in an efficient way, connect ecommerce with digital marketing, embracing post-booking ancillary upselling and cross-selling activities.

Figure 3. Customer journey mapping (identifying touch points)

Source: author’s concept, Travelport (Booth, 2016)

Figure 4. Digital and physical touchpoints for airlines

Source: author’s concept, Travelport (Booth, 2016)

In the past years, analytics are becoming more and more important for decision makers in all commercial departments. Decisions may include where, how, when, what price to offer as check-in luggage, seats, on-board meals etc. As the percentage of ancillaries grow, airline face the fact that due to the competitive environment, the need for optimisation increases. In order to get it right, airline companies need to monetize the ancillary opportunity by mix, match and math:

- airline companies need to gain insight from customer behaviour data during airline interactions with their customers;

- airline companies are positioned to offer flight-related options;

- customers book their flight in the early travel planning process, giving airlines with an opportunity to take better decisions.

According to an Amadeus study, many low cost carriers have created separate offers and ancillary products but did not apply merchandising techniques while full service carriers deal with the expansion of LCCs For the full service airlines, selecting and managing ancillary merchandising is a complex task, touching customer insights, customer intelligence and adopting a set of proper marketing activities. A study from Amadeus and Accenture (2014) has analysed the most important dimensions of merchandising ancillary services from 5 perspectives: product strategies, pricing mechanisms, communication activities, promotion, positioning (clusters and targets).

The most commonly purchased items as ancillaries are the checked-in baggage and pre-assigned seats (including exit seats, seats with more legroom). The study revealed that while most European FSC offer checked-in luggage at every point of the passenger’s journey, almost all LCC offer checked-in baggage options separately from the base fare. Most low-cost carriers offer an initial low price at the moment of the booking, but increase the price of the bag as the departure approaches. In what pre-assigned seat option is concerned, low cost carrier focus on the variations between the seat options, offering up to 10 seating zones, each zone with different features. Other ways to increase ancillaries is through upgrades, a bidding process while putting more effort into upgrading passengers as a reward, focusing on selling more premium cabins. Priority boarding is another way to increase ancillaries, companies tending to offer this services are part of higher bundling fares, a reward for airline loyalty. Another key element to enhance the revenues from ancillaries is the power of persuasion, a way that an airline approaches the customer, taking into account the ecommerce design of the website as well as the user experience. The websites of the airlines may have multiple purposes but airlines need to set up and offer visual highlighting or great messaging to influence the passenger’s decision to buy, engaging with the customer in a more advanced way. Some airline companies focus on showing the customer and encourage them to buy ancillary options by showing them that the same options will cost later or may not be available to purchase later. Other tactic would be A/B testing, mainly testing the website, run a test to see how each group will respond to different messages running during the booking or on the website. In addition to the promotion activities, the channel and time alre also important factors to consider, airline website, web check-in and mobile interactions are the focus of ancillary strategies. In what positioning is concerned, targeting the right customers with the right offers is crucial to increase revenues. Airlines can use their data to predict consumer behaviour across all promotions and placements.

3.2.Trends and New Ancillary Revenue Streams

Airlines all over the world are part of the future travel experience. As airlines seek to improve the passengers experience as well to increase revenues, airlines can improve the ancillary revenues from IFE based-retailing to very creative commercial partnerships. According to the publication Future Travel Experience, companies all over the world become more and more creative when it comes to ancillaries:

- Seatback self-service: the rollout of onboard connectivity has created a huge opportunity for airlines to expand their inflight entertainment systems to provide much more than music and video content or maps. The seatback shopping has now emerged and has a practical way to encourage the spending among all passengers. Norwegian offers in-seat food and beverage via the Android powered IFEW system. Virgin America (which is being incorporated into Alaska Airlines, ar per 2017) offers IFE based ordering. Allowing the passengers to book and pay for services and products via the IFE system is a great potential source of revenue.

- On-board concierges: on-board connectivity is a good provider for sales opportunities, allowing cabin crew to become concierges, airlines being able to earn a good commission for on-board sales of third party products. For example, cabin crew can sell holiday packages and offer advice regarding the destinations or resort activities, or sell sightseeing tours and different discount cards.

- Commercial partnerships: creating partnerships with Amazon for example to allow passengers to access the Amazon website for free. By using the offering of free on-board Wi-Fi, the airlines can negotiate a commission for any items that are search and purchased on the website during the flights, win-win situation for both parties.

- Smart watched sales: Wearable technology can become a huge retail opportunity by contactless payment option, driving in-flight sales.

- Personalised offers: Big data, small data, predictive data can actually enhance the efficiency and increase inflight sales. Airlines tracking past behaviour can personalise the passenger experience and can extend it to a more personalized sales approach.

According to Aviation Week (March, 2017) the digital push is crucial for airlines. Citing the United Nations, the mobile importance for airlines can be seen in the number of mobile subscriptions in the world: almost 7.4 billion. Instead of outsourcing, many airlines are trying to keep control over their costs and development, treating the mobile development a core skills for their strategic development. For example, Ryanair has developed the Ryanair Labs digital hub, where engineers and developers have developed their own app-in house. Air France, also developed their own app, available on iOS and Android, the mobile services being constantly improved, resulting in growing numbers of customers buying tickets and ancillary using their mobile devices. The services that are included in the mobile app are seat choices, classes upgrades, additional luggage, sales of duty free, lounge access, drinks and meals, baggage delivery, travel insurance, taxi, bus, city transfer, fare-lock option (book now and pay later). In the near future, ancillary revenues are expected to grow, due to the changes in pricing management, distribution and other options. Other airlines likes Iberia have set up partnerships with companies provide media content, focusing on opening up a new digital touchpoint, giving passengers the opportunity to buy premium content or exclusive offers for the destinations such as entry to museums or different events.

Offering Wi-Fi is the new trend, especially for European airlines which want to offer their passenger an exclusive experience. From the customers perspective, the opportunity to check the emails, surf on social media sending live impressions of your journey, stream Netflix or other video content providers is seen as a positive development to enhance the experience. As airlines equip their aircrafts with Wi-Fi, they can create using the IFE system an e-commerce platform that will encourage passengers to spend money and add a lot of value and positive experience to their travel. Such e-commerce platforms could show the passengers with the opportunity of visualising an online store that can offer them ground transport options, lounge access, different tickets to city sightseeing or other specific activities of the destination. Another revolutionary idea would be the partnership of airlines with different grocery store so that passengers could do their shopping of groceries online while flying home. In this way, the airline will be in the position to negotiate a great commission of the sales from their partners. The new generation of airlines, a generation of forward thinkers, can use data to maximise the potential while closing deals with their partners while making their passengers happy.

Companies like Air New Zealand are taking advantage of digital development, embracing technological innovations. ANZ has been analysing the customer journey to pinpoint the exact stages where ancillary products have a very limited presence and by further reinforcing the merchant approach at key points to further enhance awareness and offer the passengers the right product at the right time. In the future, the traditional on-board sales will have little room to grow, but for airlines like ANZ, pricing, distribution platforms, connectivity, and customization will be the core elements for grow the flight ancillary sales. Air New Zealand has highlighted the importance of on-demand customer segment – a growing segment, making travel choices extremely close to the departure date. According to Future Travel Experience Magazine, on-board last minute shop, customized ancillary sales fulfil the growing passengers’ needs and inflight Wi-Fi provides connectivity to the airline companies’ distribution and pricing systems, facilitating real-time sales of the in-flight ancillaries. The presence of Wi-Fi on-board the aircraft opens more opportunities for airlines all over the world to offer customized content, products and services to the passengers.

easyJet has signed a partnership with GetYourGuide to offer the passengers access to multiple tours and activities, creating a potentially ancillary revenue stream. Passengers travelling from one city to another can book different tours of the arrival city, the activities being booked on either a dedicated website, or the passenger mobile app. The passenger have the option of booking activities and tours, either after the booking or at a later date, whenever convenient for the passenger. Tickets received by the passengers are paperless, instead a QR code is offered after the purchase of their activities or tours. These activities or tours are completely integrated into the easyJet app, the passenger being able to receive notifications reminding them about their booking and itinerary.

Mobile apps are also becoming of extreme importance for the airline companies, a new ancillary revenue stream. Several apps are available on the market, which enhance the in-flight experience of the passenger who wants to upgrade the flight experience. SeatBoost, a company specializing in developing apps, has partnered with Virgin America to offer the upgrade service to passengers, who can bid in different auctions and win the seats in first or business classes. Another application available on the market is Seateroo, allowing passengers to swap seats with other passengers for a fee. The fee of the first passenger is paid to the second passengers and Seateroo receives a 15% service charge. For airlines, using Seateroo, means getting a significant proportion of any revenue stream (service fee) that could be used via the seat swap platform. Another application is Seatfrog, which allows passengers to bid for seat upgrades within a 48 hour window before the departure hour. A different technology, mainly an automation of the upgrade process and the opportunity to drive incremental revenue.

Innovations in the technology industry have a tremendous impact on airlines. FlightPath 3D help airlines to tap into the “aircraft-to-door” ancillary revenue opportunities. Using the software, passengers can enter the final address into the moving map in order to get access to customised features. For example, rather than displaying the estimated time on arrival at the final destination, the Travel Planner can draw historical real-time data to provide an accurate time of arrival at the passenger’s final airport destination. Partnerships with companies like Uber will also allow passengers to view and book different ground transportation options while they are flying, helping to make the arrival experience more enjoyable. After landing, the passengers can receive a SMS to confirm their booking and their pick-up location. The software also can preview a virtual open-top bus tour of different cities, suggesting different points of interest, complemented by the information from the tour company, along with different audio, video and written content, providing the passenger with a preview of the tour and the possibility to book their ticket in-flight and make the payment after the landing.

For airlines, the software provides an excellent opportunity to generate ancillary revenues, destination-based activities enabling airlines to provide passengers with personalized and relevant offers. Another software is Interactive Mobility, already used by Air France and Paris Airports, recreating a “Netflix style” experience for the passengers who might have a limited access to their in-flight entertainment. The software focuses on the travel experience, offering entertainment on both in-flight but also on the ground, allowing passengers to download many types of content before they travel for consumption in-flight, while the media kiosk offered by the app allows passengers to enjoy their time in the waiting lounges or at the gate areas. Also, post-flight passengers can access content such as destinations guide. Fir airlines and airports, it can be an excellent tool for increase revenue, as they might choose to give limited content for free or charge passengers for access. Lufthansa Systems focuses on audio and ancillaries, expanding the BoardConnect partner network to offer airlines more choices of entertainment content and ancillary services. For Lufthansa Systems, audio quality is the most overlooked element of the in-flight entertainment experience, taking steps to launch the Virtual Sound module, providing cinema-like sound, regardless of the types of headphones used.

3.3.The Connectivity Revolution for Airlines – Inflight Broadband and Importance on the Ancillaries

For the airline industry, connectivity retail models are of extreme importance. High-speed inflight broadband is the key that enables new ancillary revenue streams, but the cost of inflight broadband is significant and airlines must be very creative when it comes it the business models. Different airline companies offer free Wi-Fi in business class or above, but other include this to premium-economy passengers in return for loyalty programme points, recognising that frequent flyers are most likely to be traveling for business. Inflight broadband is seen by most passengers as an added-value service, either they have to pay for it or benefit from it free if it is charged. According to a study by Inmsarsat Aviation, conversion rates are better managed with free-trials and limited access plans. When service is reliable as on the ground, 75% of passengers out reliability of inflight broadband before the price they have to pay for the connection. In Europe, for example, Lufthansa introduced a three tier system based on service speed: passengers can access the internet on the device of their choice via Lufthansa’s FlyNet portal, 3 packages being available at different starting points, low as 3 euros in short haul for messages or choose another tier to stream videos or browse the web. A trial is offered as well, 10 minutes (10MB) “try before you buy” allowing passengers to experience the service before buying it. In the US, Virgin America partnership with LinkedIn to allow business class passengers to watch business-skills videos at LinkedIn owned Lynda.com for free. Customization is extremely important, Lufthansa’s package system allowing passengers to be presented with the freedom of choosing the right package for them, in line with growing the brand awareness in order to create individual customer offers.

According to an Inmarsat Aviation study (2017), around 3.8 billion passengers fly on an annual basis, but only 25% of the planes flying offer on-board broadband. Using IATA data, the study revealed that a doubling in the number of passengers to 7.2 billion annually will trigger a 30 billion dollars in broadband ancillary revenue by 2035, a total of 130 billion dollars of additional revenues. By 2035, broadband based revenue is forecasted to remain the highest single source of ancillary revenues, accounting 53% of the total market, an estimated value per passenger of 4 dollars. Combining content, products and services is a good way to develop related ancillary revenue for both LCC and FSC, LCC forecasted to account 11 billion dollars of revenues while FSC around 19 billion dollars. The study also reveals that by 2035, from the estimated 30 billion dollars from the total 130 billion dollars, Asia-Pacific will have the highest share at around 10.30 billion dollars, followed by Europe with around 8.2 billion dollars, North America with 7.6 billion dollars, Latin America with 1.9 billion dollars, ME with 1.3 billion dollars and Africa with around 0.58 billion dollars. The growth in revenue solely depends on how airlines are using data to a much greater extend, taking into account that today only 11% of the airline schemes offer customised rewards based on purchase history or location. According to the study, having loyal customers means 23% premium in profitability and revenue to all airlines.

As mentioned before, many airlines charge differently for broadband connectivity on-board their planes, being the primary ancillary digital revenue with advertising revenue, premium content and customized revenue. Often, due to the lack of bandwidth and its reliability and quality, airlines have not been able to monetize such opportunities.

The airline companies need to use the opportunities given by the high-quality broadband in order to improve the customer experience and increase ancillary revenues. A change in this sense could enable airlines to use consumer preference information, target specific travellers, offer opportunities to purchase ancillary products or services across many devices and ultimately enhance air travel experience. According to the study, 85% of the passengers can be influenced to make a purchase in a connected cabin if they confide that relevant content or products exist.

Figure 5. The evolving airline ancillary revenue model, the evolution of passenger expectations for broadband in the cabin

Source: Inmarsat Aviation Study (2017)

3.4. Opportunities for the Airline Companies – Broadband Ancillary Revenues

Existing researches have focused solely on the traditional model of opportunities, but few have focused on the broadband opportunities, which could become a gold mine for airlines all over the world. The broadband enabled ancillary revenue model represents a mix of existing broadband airline ancillary revenue and new opportunities: premium content, advertising, e-commerce and broadband access revenue.

Figure 6. Broadband enabled ancillary revenues mix

Source: Inmarsat Aviation Study (2017)

- Broadband Access Revenue: the most widely utilised revenue category for airlines and technology or service providers for inflight broadband connectivity. Many airlines nowadays derive revenue from access charges with multiple options (per day, per hour, per flight etc.). These elements depend on the airline strategy, some of them providing connectivity free on charge, but with later options for upgrading.

- Advertising: the study has segmented the category between revenue from page impressions and click-through in both paid and free access options and revenue from interrupting-adverts for the free access. The development of online marketing and commercial opportunities can generate revenue from adverts viewed by the passengers on a revenue-sharing basis with the potential to offer tailored adverts and content specific to destinations, countries, routes, target passengers (business versus economy passengers). The additional area of revenue can derive from the free access mode that interrupts content with short adverts as those from Youtube, Spotify, Soundcloud etc.

- Premium content: currently many airlines allow passengers to bring their own devices and offer premium options. The premium content category can include live content, wireless inflight entertainment, on-demand video. All these elements can represent a huge ancillary revenue opportunity for the airlines, charged over the content provided by the IFE, a premium standalone service. The airlines could offer different bundles like basic content that may include news or other content while a premium bundle could include premium content like “box sets”.

- E-commerce and Destination Shopping: in the e-commerce model eased by the inflight broadband, passenger can be targeted by using a number of ways to define a package that take advantage of a targeted market, such as late bookings or even opportunistic purchases. A good feature of this revenue model is the ability of the airlines to personalise offers based on passenger knowledge, if the passengers have been utilising the airline’s app to book the flight or manage its booking. This also gives the opportunity to capitalise the penetration of logistical companies to partner with the airlines.

The opportunities that broadband connectivity offer can enable airlines to meet passengers expectations in regards to quality and reliability. Although revenue can be generated across all above mentioned categories, the increase will depend on some factors such as the strategic relationships with global brand which can provide content, bargaining power with all suppliers (advertisement revenue sharing and add fess/page impression fees), margins obtained from selling products or services by the airline in terms with the contracts negotiated with suppliers, the flown routes or destinations and which services can be enabled by the broadband, the passengers segments (LCC vs FSC, business passengers versus leisure, short-haul routes versus long-haul routes) and the airline strategy which may outsource all broadband ancillary revenues and ask for a commission from the provider.

4. Conclusion

The internet and technology has shaped the way airlines make business and establish trends while for us, the consumers, it has changed the way we travel. The connectivity is helping airlines to increase the on-board sales by providing a simpler, faster and much more secure way to do shopping on-board the aircraft. Connectivity also makes easier the on ground delivery for passengers much easier and for airlines it’s shaping an easier way to know their passenger to a closer scale, offering consumers personalized services and a much more extraordinary inflight experience. Product differentiation is a key enabler for airlines all over the world to compete with each other as innovation is very dynamic and gives airlines the flexibility to target passengers, offer consumers targeted offers and message. In order to offer a better experience, airlines must learn from the e-commerce companies and personalise recommendations and offer, increasing the conversion rate. Airlines must move from a strategy that concerns just seat sales and yield maximization to a more customer centred focus, using the power of individual customer data across the entire journey. The potential to create value for each passenger is huge and airlines are starting to use it. For example, British Airways uses a “Know Me’ feature to allow a more in-depth analysis of the customer to offer personalised services, while other companies like United moved from a traditional collect and analyse approach to a more smart “collect, detect and act” strategy that proves to be of extreme success. Being a trend-setter in the airline industry means changing perspectives and start changing behaviours by using data to provide a more personalised experience and start shifting from selling seats to a more digital retailer approach.

References

- Accenture, 2016. Make your digital connection: from digital strategy to airline strategy [online] Available at: https://www.accenture.com/t20160524T005913Z__w__/us-en/_acnmedia/PDF-16/Accenture-Make-Your-Digital-Connection-From-Digital-Strategy-to-Airline-Strategy.pdf [Accessed 11 September 2017].

- Amadeus, 2017. Merchandising in 2017: Trends in airline ancillaries. [online] Available at: http://www.amadeus.com/documents/airline/research-reports/accenture-amadeus-alliance-ancillary-merchandising-report-2017.pdfaccessed September 2017 [Accessed 11 September 2017].

- Batra, A. and Bapat, V.P., 2016. At the heart of new opportunities – Soaring higher with ancillary revenues, leveraging technology, NTT Technologies. [online] Available at: http://www.niit-tech.com/sites/default/files/Ancillary%20revenues%20Soaring%20opportunities%20in%20Airline%20operations.pdf [Accessed 11 September 2017].

- Bejar, R., 2009. Airline Trends and Ancillary Revenue Report 2010. [online] Available at: http://www.airsavings.net/whitepapers/Airsavings%202010% 20ForecastJan2010.pdf [Accessed 11 September 2017].

- Bohlman, J., Kletzel, J., Terry, B., 2017. Digitize and reassess your competitive position: 2017 Commercial Aviation Trends, Pricewatercoopers.

- Booth, E., 2016. How Mobile is empowering airlines to drive ancillary revenues. Travelport Digital Magazine.

- Chen, C.C., and Schwartz, Z., 2013. On revenue management and last minute booking dynamics. International Journal of Contemporary Hospitality Management, 25(1), pp: 7-22.

- Christin et al, 2014. Always Connected: A first insight into the influence of smartphone adoption on the activity-travel behaviour of mobile professionals in Indonesia. Social Technologies, 4(1), pp.76-92.

- Future Travel Experience Magazine, 2015. 5 ways for airlines to boost in-flight ancillary revenues. [online] Available at:http://www.futuretravelexperience.com/2015/07/5-ways-for-airlines-to-boost-in-flight-ancillary-revenues/ [Accessed 11 September 2017].

- Future Travel Experience Magazine, 2016. Latest IFEC innovations present airlines with new entertainment and ancillary revenue opportunities. [online] Available at: http://www.futuretravelexperience.com/2016/11/ifec-innovations-present-airlines-with-new-ancillary-revenue-opportunities/ [Accessed 11 September 2017].

- Future Travel Experience Magazine, 2017. easyJet creates new digital ancillary revenue stream with GetYourGuide partnership. [online] Available at: http://www.futuretravelexperience.com/2017/05/easyjet-creates-new-digital-ancillary-revenue-stream-with-getyourguide-partnership/ [Accessed 11 August 2017].

- Future Travel Experience Magazine, 2017. Air New Zealand eyeing digital retailing improvements to boost ancillary revenues. [online] Available at: http://www.futuretravelexperience.com/2017/06/air-nz-eyeing-digital-retailing-improvements-to-boost-ancillary-sales/ [Accessed 11 September 2017].

- Future Travel Experience Magazine, 2017. Airlines presented with revolutionary in-flight ancillary opportunities as Wi-Fi rollouts gather pace. [online] Available at: http://www.futuretravelexperience.com/2017/01/airlines-presented-with-revolutionary-in-flight-ancillary-opportunities/ [Accessed 11 September 2017].

- Future Travel Experience Magazine, 2017. Mobile apps present airlines with huge ancillary revenue opportunities. [online] Available at: http://www.futuretravelexperience.com/2016/09/mobile-apps-airline-ancillary-revenue/ [Accessed 11 September 2017].

- Granados, N., Kauffman, R.J., Lai, H. & Lin, H., 2015. À la carte pricing and price elasticity of demand in air travel. Decision Support Systems, 53, pp. 381-394.

- Grous, A., 2017, Quantifying the commercial opportunities of passenger connectivity for the global airline industry, Inmarsat Aviation Publication.

- Imbruglia, R., 2012. Ancillary revenues in some sectors of the tourist industry. Revista di Scienze del Turismo, February 2012, pp. 93-120.

- Inmarsat Aviation Publication, 2017. Advertising, big data and the power of personalisation, [online] Available at: https://www.inmarsataviation.com/benefits/revenue-opportunities/Advertising-big-data-and-the-power-of-personalisation [Accessed 11 September 2017].

- Inmarsat Aviation Publication, 2017. Connecting the captive market. [online] Available at: https://www.inmarsataviation.com/benefits/revenue-opportunities/Connecting-the-captive-market [Accessed 11 June 2017].

- Inmarsat Aviation Publication, 2017. The future of inflight retail. [online] Available at: https://www.inmarsat.com/wp-content/uploads/2016/01/Passenger-digital-brochure.pdf [Accessed 11 June 2017].

- Iztok, F. 2016. How to become an airlines ancillary revenue leader – trends from ancillary merchandising. Diggintravel – Smarter Travel Marketing.

- Jenner, G., 2017. Analysis: Ancillary revenue gains hinge on ending siloed approach. FlightGlobal Magazine, February.

- Liu, J., 2017. Thoughts on loyalty and ancillaries in aviation, The EveryMundo Blog. [online] Available at: https://www.everymundo.com/thoughts-loyalty-ancillaries-aviation/ [Accessed 11 September 2017].

- Martin, J.C., Roman, C., Espino, R., 2011. Evaluating frequent flyer programs from the air passengers’ perspective. Journal of Air Transport Management, 17, pp.364-368.

- Massy-Beresford, H., 2017. Digital drive helps European airlines boost ancillary revenue. Aviation Week Network Online Publication. [online] Available at: http://aviationweek.com/connected-aerospace/digital-drive-helps-european-airlines-boost-ancillary-revenue [Accessed 11 June 2017].

- O’Connell, J.F., 2011. Ancillary Revenues e the New Trend in Strategic Airline Marketing. In: O’Connell, J.F., Williams, G., Eds. Air Transport in the 21st Century. Ashgate: Aldershot.

- O'Connell, J.F. and Warnock-Smith, D., 2013. An investigation into traveler preferences and acceptance levels of airline ancillary revenues. Journal of Air Transport Management, 33, pp.12-21. doi:10.1016/j.jairtraman.2013.06.006.

- O'Connell, J.F. and Warnock-Smith, D., 2013. An investigation into traveler preferences and acceptance levels of airline ancillary revenues. Journal of Air Transport Management, 33. pp. 12-21.

- Schrage, D., Scholl, S., 2014. The importance and consequences of ancillary services to the airline industry. What benefits and risks are associated with “unbundling” of ancillary revenues?, Prologis, Experts in Aviation Consultancy.

- SITA, 2017. Big data: a big boost for ancillary revenues. [online] Available at: https://www.sita.aero/resources/type/white-papers/big-data [Accessed 11 June 2017].

- Sorensen J., 2011. Ancillary Revenue Strategies: Five Success Factors. In: Conrady R., Buck M., eds. Trends and Issues in Global Tourism 2011. Trends and Issues in Global Tourism. Berlin: Springer.

- Sorensen, J., 2017. 2016 Top 10 airline ancillary revenue rankings. Ideasworks and Cartrawler [online] Available at: http://www.ideaworkscompany.com/wp-content/uploads/2017/07/2016-Top-10-Airline-Ancillary-Revenue-Rankings.pdf [Accessed 11 September 2017].

- Sorensen, J., 2017. The 2017 CarTrawler Yearbook of Ancillary Revenue. Ideasworks and Cartrawler [online] Available at: http://www.ideaworkscompany.com/wp-content/uploads/2017/09/2017-Ancillary-Revenue-Yearbook.pdf [Accessed 11 September 2017].

- Steven, L., Uddin, N., 2017. Airline Ancillary Services: An investigation into Passenger Purchase Behaviour. Journal of the Transport Research Forum, 56(1), pp: 41-62.

- Wittmer, A. Oberlin, N., 2012. Airline Revenue Pricing. Center of Aviation Competence of St. Gallen. [online] Available at: https://www.alexandria.unisg.ch/243853/1/14Wittmer.pdf [Accessed 11 June 2017].

- Wittmer, A., Rowley, E., 2014. Customer value of purchasable supplementary services – The case of a full network carriers’ economy class. Journal of Air Transport Management, 34, pp. 17-23.

Article Rights and License

© 2017 The Author. Published by Sprint Investify. ISSN 2359-7712. This article is licensed under a Creative Commons Attribution 4.0 International License.