Keywords

JEL Classification M31

Full Article

1. Introduction

One of the main factors that transform the business world into more customized ventures is represented by Information Technology (IT), starting from personalized service, new product innovation, and identification of market opportunities. The role of IT also penetrates the business management sector in terms of business development plans, improvement of the management system to the implementation of a management process that is highly oriented to the existence of digitally presented information (Liao and Cheung, 2002). The same development happened in the financial industry. IT has made possible the delivery of a service to customers carried out in a very personal way, by creating customized products that are tailored to the needs of each individual customer (Wang et al., 2003). Product innovations in the online banking sector include providing ATMs, SMS banking, internet banking, and mobile banking. The role of IT in the banking industry continues to be improved to answer challenges, as well as opportunities because of the higher penetration of internet usage among banking customers. It becomes a challenge if the banks are not accommodating the changes in customer behavior related to their interaction with IT. It becomes an opportunity because customer involvement in IT will become a direct channel for innovative offerings by banks to meet customers' specific needs for banking products and services (Wang et al., 2003).

Internet banking is actually a product of banking industry, a development that is relatively new. A breakthrough is made to utilize virtual space through the use of the development of internet technology, social media and the World Wide Web (Shih and Fang, 2004). This internet banking offers unlimited opportunities to increase customer loyalty while improving the performance of banks (Al-Somali et al., 2009). Customers will receive many benefits by switching from conventional to internet banking based products (Pikkarainen, 2004). From a number of previous studies, it was frequently mentioned the benefits of online banking for the customers, such as the easiness of accessing information about new banking offers. At the same time, the bank can easily send messages personally to each individual targeted customer (Pikkarainen, 2004; Wang et al., 2003). From this explanation, it can be noted that the transition of bank offerings from conventional to digital products provides benefits not only for the banks, but also for their customers. With online banking, conducting financial transactions is much easier, without having to leave home and can be done at any time (Karjaluoto et al., 2002).

The intention of this study is to find out and analyze the influences of IT Trust on IT Acceptance of internet banking (IAIB) customers in Indonesia. Another hypothesis is also being developed, namely to examine the impact of IT Trust on the interest customers converting to IB. This research is also testing and analyzing the influence of IT Acceptance on interest to convert both directly or through IT Acceptance. The moderating effect of gender is also being explored to deepen the findings of this study.

2. Literature Review

2.1. Converting to Internet Banking

Because the intention to convert to a new product is an attitude statement about how someone behaves in the future, bank managers must comprehensively understand the variables that need to be intervened with to increase the degree of intention to purchase until he or she reaches the stage of converting to internet banking (Eriksson et al., 2005). One of them is by increasing their commitment to conversion. Commitment can arise from the accumulation of experience and knowledge of other customers who are colleagues or friends, to a brand that creates a strong interest that ultimately also raises the commitment of customers to convert to banking products. The Customer assumes that this method is more reliable than if he/she were to find out about the benefits of this product from the available public information channels. (Youne and Suna, 2004).

2.2. Customer IT Acceptance Value

The use of internet banking (IB) has now become very popular, but some bank customers are not always opened to adopt it. The use of systems and technology in IB requires the acceptance of technology, which for some customers becomes complicated as it involves changes in their behavior patterns (Abu Shanab and Pearson, 2010). Technology can simplify consumer understanding of financial transactions, however on the opposite side, it is also more difficult for them, because of the necessity of customers to change their behavior of conducting transactions using conventional banking over the years.

To use the IB transactions, consumers are not only required to understand a technology in depth, but more importantly he or she needs to understand the banking products. Because of the complex products offered by financial service providers, sometimes it is also difficult for customers to trace information related to the description of the products. With the IT, this complexity can be overcome (Mattila et al., 2003)

2.3. Technology-Based Trustworthiness

Managing Customer Trust through information communication at various levels in the business process is becoming more crucial nowadays (Bachri et al., 2016). Confidence management uses an important technology that can be run by a Manager if they do not want to be left behind by competitors (Eid, 2013). Associated with the use of technology in conducting financial transactions, money is still overshadowed by the sense that certain risks can occur. Therefore, trustworthiness is an important factor for banks to guarantee risk-free transactions, and then the negative feelings will be reduced (Reid and Levy, 2008). Trust of people is an important part of the internet banking transaction process, whether it is run safely or not (Roca and García, 2009).

Trust in online banking technology is an important mediator in getting consumers to increase the frequency of transactions and the value of online banking (Alsajjan and Dennis, 2006; Roy and Kesharwani, 2012). Performance perceptions based on trust and reliability must have an impact on the cost and value or perceived benefits of consumers. This means reducing user costs, however on the other hand, there is an increase in psychological benefits. Higher psychological benefits occur when consumers become more convinced that this technology will not fail when online transactions are made (Alawneh, 2013; Harris and Spence, 2002). Awareness that adequately safeguards against the use of technology will reduce the concerns and fears of consumers to conduct online transaction processing. This condition should provide functional benefits in improving customer confidence in any online banking product (Harris and Spence, 2002).

3. Research Hypotheses

Based on the framework of the research that has been described before, the hypotheses of the study are established as follows:

H1. IT Trust affects IT Acceptance for internet banking customers in Indonesia.

H2. IT Trust affects the interest of converting internet banking for internet banking customers in Indonesia.

H3. IT Acceptance affects the interest in converting internet banking for internet banking customers in Indonesia.

H4. IT Trust affects the interest of converting internet banking to internet banking customers in Indonesia through IT Acceptance.

H5. Gender moderates the relationships in the model, for internet banking customers in Indonesia.

4. Research Methodology

4.1. Location and Research Objects

The location chosen for this research is the internet banking industry in Indonesia. However, the focus of the research is directed to the concentrated areas of Aceh in Banda Aceh and North Sumatera, which are further concentrated in Medan City, since both cities encompass the most internet banking customers. The Customer's Trust on Technology Reliability, Customer's Acceptance of Value IT, and Converting Intention on Internet Banking in Aceh and North Sumatra Region are the research variables that have been selected for this analysis and examined in an effort to uncover the phenomena that have been developed in this study.

4.2. Data Collection and Sampling

A population is the subject of the researcher's focus to be studied and then draw conclusions (Hair et al., 2010). This population refers to the entire sample of people, events, or behaviors to be researched (Sekaran 2016). In this study, the population is the entire number of existing customers Internet Banking in Aceh and North Sumatra, which is infinite. Determination of the sample is based on Sekaran Uma (2016) who stated that the sample size for multivariate research ranged from 100 to 500. In this study, the authors used 387 respondents, which included 200 respondents located in North Sumatra, and 187 respondents in Aceh.

Figure 1. Sample Distribution

5. Results and Discussion

The research model used in this research was a tiered model and to test the proposed hypotheses we have used the SEM technique (Structural Equation Modeling) operated through AMOS 22 program.

Testing and verifying the hypotheses were done by using two criteria of testing, which were Critical Ratio (C.R.) and Probability value. The hypothesis would be accepted if the value of CR and P passed the cut off value. The required CR value was at least 1.96, while the P value must be ≤ 0.05 (Gozhali, 2011). Then, hypothesis testing was performed step by step in accordance with the hypothesis of the model.

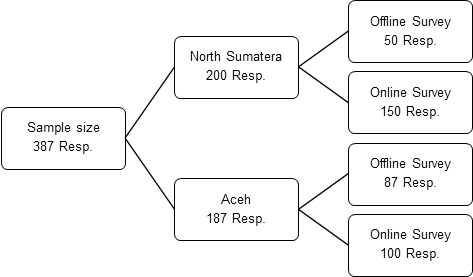

Figure 2. Confirmatory Factor Analysis

Note: ‘Converting IB’ = Converting Intention to Internet Banking, IT Trust = Trust in IT systems,

IT Acceptance = Acceptance of Information Technology

The following tables show the relationship of indicators with each construct. Loading factor used to measure the contribution of each indicator to their respective constructs. When the value was above 0.6, then it was said that the indicator was representative enough to explain the variable. This indicator should, therefore, be included in subsequent data processing.

Table 1. Loading Factor Education Variable

| Relationship | Estimate | Relationship | Estimate | Relationship | Estimate | ||||||

| IT1 | ← | IT_Trust | 0,858 | CIB1 | ← | Coverting_IB | 0,888 | ITA1 | ← | IT_Acceptance | 0,921 |

| IT2 | ← | IT_Trust | 0,846 | CIB2 | ← | Coverting_IB | 0,886 | ITA2 | ← | IT_Acceptance | 0,887 |

| IT3 | ← | IT_Trust | 0,848 | CIB3 | ← | Coverting_IB | 0,828 | ITA3 | ← | IT_Acceptance | 0,909 |

| IT4 | ← | IT_Trust | 0,874 | CIB4 | ← | Coverting_IB | 0,905 | ITA4 | ← | IT_Acceptance | 0,897 |

| IT5 | ← | IT_Trust | 0,873 | CIB5 | ← | Coverting_IB | 0,777 | ||||

| IT6 | ← | IT_Trust | 0,846 | ||||||||

Based on Table 1, it can be explained that all indicators of exogenous and endogenous variables used in this study showed good results with the loading factor value ≥ 0.50. These results indicate that all indicators were significantly representing these variables of the model. To see if the model is built in accordance with the existing data. The feasibility of the model needed to be tested using the premises of Goodness of fit. The following indicators were some conformity indexes and cut-off values to test whether a model showed a good fit or not with the existing data (Hair et al., 2007).

Table 2. The goodness of Fit Criteria Measurement Models

| Criteria | Critical Score | Model Result | Model Evaluation |

| CMIN/DF | ≤ 3,0 | 2,91 | Fit |

| RMSEA | Less than 0,08 | 0,08 | |

| NFI | ≥0,90 | 0,93 | |

| Parsimony-Adjusted Measure | 0,83 | ||

| AGFI | ≥0,83 | ||

| TLI | ≥ 0,95 | 0,94 | |

| Criteria | Critical Score | Model Result | Model Evaluation |

| CFIA | 0,637 | Fit | |

| AIC | Independence ≥Default ≥ Saturated | 3931,675≥ 319,723≥ 240,000 | |

| ECVI | Independence ≥Default≥ Saturated | 16,180 ≥ 1,316≥ ,988 |

From Table 2, it can be seen that in general, the model built for this study fits with the data. It can be concluded that the existing measurement model has met the goodness of fit criteria so that output out of this model can be interpreted related to the relationship between the indicators with the construct respectively.

5.1. Hypothesis Testing

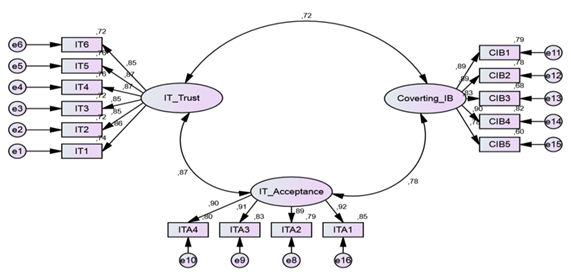

The next analysis was hypothesis testing using the Structural Equation Model (SEM) analysis. Results of data processing for SEM analysis cam be seen in Figure 3 below:

Figure 3. Structural Equation Model

Note: ‘Converting IB’ = Converting Intention to Internet Banking, IT Trust = Trust in IT systems,

IT Acceptance = Acceptance of Information Technology

Hypothesis testing using two criteria that is CR value > 1,96 and p-value <0,05. The output of the Structural Equation Model on AMOS 22.0 shows the following results:

Table 3. Impact among Variables

| Examined relationship | Est. | S.Er. | C.Ratio | P-Value | Notes | |||

| H1 | IT_Acceptance | ← | IT_Trust | 0,897 | 0,055 | 16,210 | *** | Hypothesis not rejected |

| H2 | Coverting_IB | ← | IT_Acceptance | 0,643 | 0,112 | 5,736 | *** | Hypothesis not rejected |

| H3 | Coverting_IB | ← | IT_Trust | 0,165 | 0,112 | 1,470 | 0,142 | Hypothesis rejected |

Note: ‘Converting IB’ = Converting Intention to Internet Banking, IT Trust = Trust in IT systems,

IT Acceptance = Acceptance of Information Technology

In H1, we aimed to test the effect of IT Trust on IT Acceptance and this hypothesis has been accepted since the Critical Ratio value was above 1.96 and P-value was <0.05. These results were in line with the conclusion of the research led by several previous researchers such as Lee (2008) and Jusoh (2012) who found a positive influence from the variables IT Trust on IT Acceptance.

H2 tested the effect of IT Acceptance on Converting Intention and the results were also significant. This is in line with the findings of the research conducted by Yu (2008) and Al Rfou (2013).

However, H3 was rejected because both CR values and P value did not meet the criteria. In other words, there was no significant influence between IT Trusts to Converting Intention to Internet Banking (IB).

The following section tests whether the IT Acceptance could become a mediating variable between IT Trust against Converting Intention to Internet Banking (IB). Testing was done by using the Bootstrapping option in AMOS 22.0.

Table 4. Indirect Effects. Standardized Indirect Effects - Two-Tailed Significance (BC)

| IT_Trust | IT_Acceptance | Coverting_IB | |

| Coverting_IB | 0,001 | ... | ... |

Table 4 above shows that the value of indirect effect p between IT Trust to Converting Intention to Internet Banking (IB) is 0,001. Because it was <0,005, we could say that the IT Acceptance variable is a mediator that mediates the influence of IT Trust on Converting Intention to Internet Banking (IB). Since the influence of direct IT trust on Converting Intention to Internet Banking (IB) is insignificant, and influence, after it is mediated by IT Acceptance, becomes significant, in this case, IT Acceptance was a full mediating variable of the influence of IT Trust to IB Converting.

Table 5. Magnitude Influence of Indirect Effect

| IT_Trust | IT_Acceptance | Coverting_IB | |

| IT_Acceptance | 0,000 | 0,000 | 0,000 |

| Coverting_IB | 0,561 | 0,000 | 0,000 |

Note: ‘Converting IB’ = Converting Intention to Internet Banking, IT Trust = Trust in IT systems,

IT Acceptance = Acceptance of Information Technology

Magnitude value of influence of IT Trust to Converting to Internet Banking through IT Acceptance was 0,561. This means that IT Trust could increase the interest of prospective customers to shift from the conventional banking system to internet banking by 56.1%.

Moderation Analysis

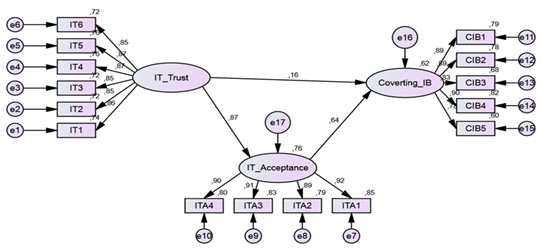

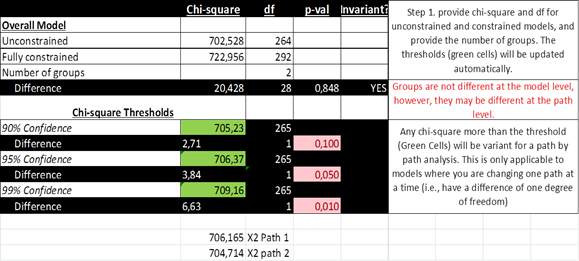

In this article, the type of moderation used is multi-group moderation with the gender variable used as the control variable. The goal is to see if there is a real difference between male and female in terms of his or her behavior to switch to Internet Banking.

Overall, there is no difference between the Male group and Female group because the p-value comparison X2 for both groups is 0,848> 0,05. As analyzed in Figure 4, the groups are not different from a model standpoint, however they may be different at a path level. However, when compared to the path by path, the result is somewhat different. For path 1, X2 is 706,165> 705,23 at a 90% confidence level. This means there is a difference between male group and female Group for path 1 (IT Trust to IT Acceptance). In the Male group, the influence of IT Trust on IT Acceptance is more dominant than in the Female group. Nonetheless, these differences are not relevant because of the insignificance level of multi-group analysis based on the chi-square test.

Figure 4. Multi-Group Analysis

6. Discussion and Conclusion

The conclusions drawn from this study are as follows:

6.1. Theoretical Contributions

Of the 3 direct-effect hypotheses tested, one of them is the effect of IT Trust on Converting Intention to Internet Banking (IB) is not significant. In other words, there is no influence between IT Trust variable to Converting Intention to Internet Banking (IB).

The ‘IT Acceptance’ variable serves as a full mediation variable that connects IT Trust variables to Converting Intention to Internet Banking (IB). In multi-group moderation analysis that sees gender as its control group, however, overall there is no difference significant behavior of female and male customers.

6.2. Implications for Managers

IT Trust only affects the increase of customer intention to switch to Internet Banking if it is examined through IT Acceptance. Therefore, strategic steps are needed to increase the customers' trust in IT used in conducting Internet Banking tasks. Because of its role as Full Mediation, IT acceptance variables play an important role to increase customers' interest in switching to Internet Banking. Therefore, special effort is required by bank management to increase customer acceptance of the use of IT in the banks.

6.3. Limitation and Future Direction of Research

Since this research only covered two provinces, it will be more comprehensive if the future research is expanded to cover all 8 provinces in Sumatra. Thus, the results will be better in describing and representing customer behavior as it switched to internet banking.

References

- Abu-Shanab, E., Pearson, J.M. and Setterstrom, A. J., 2010. Internet Banking and Customers’ Acceptance in Jordan: The Unified Model’s Perspective. Communications of the Association for Information Systems, vol. 26, no. 23, pp. 493–524.

- Alawneh, A. Al-Refai, H. Batiha, K., 2013. Measuring User Satisfaction from E-Government Services: Lessons from Jordan. Journal of Government Information Quarterly, 30, pp.277-288.

- Al-Rfou, A.N., 2013. The Usage of Internet Banking Evidence from Jordan. Asian Economic and Financial Review, 3(5), pp.614–623.

- Alsajjan, B. and Dennis, C., 2006. The Impact of Trust on Acceptance of Online Banking. European Association of Education and Research in Commercial Distribution, (June), pp.1–19. [online] Available at: http://bura.brunel.ac.uk/handle/2438/738 [Accessed on 12 May 2018].

- Bachri, N., Rahman Lubis, A., Nurdasila and Abd. Majid, M.S., 2016. Credibility and Consumer Behavior of Islamic Bank in Indonesia: A Literature Review. Expert Journal of Marketing, 4(1), pp. 20-23.

- Bradley, L. and Stewart. K., 2003. A Delphi Study of Internet banking. Journal of Marketing Intelligence and Planning, Vol. 21, No.5, pp.272-281.

- Chang, Y.T., 2003. Dynamics of banking technology adoption: an application to internet banking. Policy, 44, pp.1–47.

- Eriksson, K., Kerem, K. and Nilsson, D., 2008. The adoption of commercial innovations in the former Central and Eastern European markets: The case of internet banking in Estonia. International Journal of Bank Marketing, Vol. 26, No. 3, pp.154-169.

- Ghozali, I., 2005. Aplikasi Analisis Multivariate dengan Program SPSS. Semarang: Badan Penerbit Universitas Diponegoro.

- Hair Jr., J.F., Black, W.C., Babin, B.J. and Anderson, R.E., 2010. Multivariate data analysis 7th ed., New Jersey, US: Pearson Education.

- Jusoh, A., 2012. The Effects of Computer Self-Efficacy and Technology Acceptance Model on Behavioral Intention in Internet Banking Systems. Procedia - Social and Behavioral Sciences, 57, pp.448–452. doi: 10.1016/j.sbspro.2012.09.1210.

- Lee, Y., 2009. Exploring the Influence of Online Consumers’ Perception on Purchase Intention as Exemplified with an Online Bookstore. Journal of Global Business Management, 5(2), pp.1-9.

- Mattila, M., Karjaluoto, H., and Pinto, T. 2003. Internet Banking Adoption among Mature Customers: Early Majority of Laggards? Journal of Services Marketing Vol. 17 No. 5 pp. 514-528

- Pikkarainen, et al., 2004. Consumer acceptance of online banking: an extension of the technology acceptance model. Internet Research, 14(3), pp. 224-235

- Reid, M. and Levy, Y., 2008. Integrating Trust and Computer Self Efficacy with TAM: An Empirical Assesment of Customers Acceptance of Banking Information Systems (BIS) in Jamaica. Journal of Internet Banking and Commerce, Vol. 13, No.3, pp.1-18.

Article Rights and License

© 2018 The Authors. Published by Sprint Investify. ISSN 2359-7712. This article is licensed under a Creative Commons Attribution 4.0 International License.